Thinking about starting a new course can be exciting, but worries about finance often hold people back. Many adult learners hesitate because they are unsure about the funding options available to them.

The Advance Learner Loan is designed to make studying in England more accessible. It covers your course fees, so you don’t have to pay upfront, allowing you to focus on learning and building your future.

At London Cactus College, we guide you through the loan application from start to finish. From checking eligibility to submitting your application, we make the process simple, clear, and stress-free.

This loan can cover the full fee for many qualifications, including professional and higher education courses. That means you can start your course now and repay the loan later, once you’re earning. It’s a flexible way to invest in your future without feeling overwhelmed.

The Advance Learner Loan is a government-backed loan for learners aged 19 or over studying eligible courses at recognised colleges or training providers in England. It allows you to cover course fees without paying upfront, and repayment only starts once you’re earning above a certain income threshold.

Many learners use this loan to take courses in fields like healthcare, education, IT, and more. If your dream is to work in nursing, this funding can help you take the first step—check out our guide on how to become a nurse to see alternative routes and the Access to HE Diploma.

You can apply if you:

Are 19 or over

Are studying an eligible course at a recognised provider in England

Meet the residency requirements

Haven’t already completed the same qualification at the same level

This includes adult learners, career changers, and those returning to education after a break. If you want to explore careers in health and social care, this loan can support you – see our guide on how to start a career in health and social care for more details.

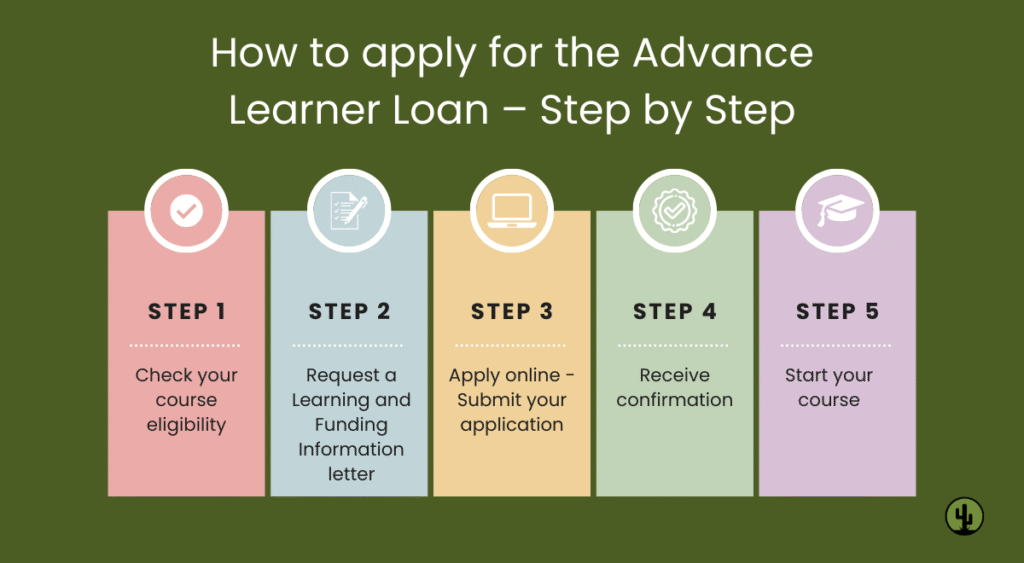

Applying for an Advance Learner Loan is straightforward, especially with our support at London Cactus College. Here’s how it works:

Check your course eligibility – Confirm with your college or training provider that your course qualifies for the loan.

Request a Learning and Funding Information letter – This letter contains the details about your course and is required to complete your application.

Apply online – Register on the official student finance website. If you cannot apply online, postal applications are also accepted.

Receive confirmation – Once approved, you’ll get a letter confirming your loan, usually within two weeks for online applications (postal applications take longer).

Start your course – Focus on learning while we ensure your funding is in place.

With London Cactus College guiding you, the process is simple and stress-free.

The amount you can borrow depends on your course fees. Most learners can cover the full tuition fee, but it’s best to check with your college. Repayment only begins once you’re earning above the threshold, so you won’t have to worry about paying upfront.

No upfront fees – Start learning without financial stress

Flexible repayment – Only repay when your income is above the threshold

Supports career change – Ideal for adult learners returning to education

Covers many courses – From professional qualifications to higher education

This loan is a great way to invest in your skills and career without delaying your learning goals.

Repayment only begins once you’ve completed your course and your income is above the repayment threshold (currently £27,295 per year for most learners). If you’re not earning above this level, you won’t make repayments. Payments are automatically deducted from your salary, making it simple and stress-free. Interest is applied, but it’s calculated carefully to keep repayment manageable.

If you take an Access to HE Diploma in Nursing, there’s a helpful benefit: once you successfully complete a higher education course, any outstanding loan balance for your Access to HE course can be cleared. This means you won’t have to repay that part of your loan, making it easier to progress to university without extra debt.

It’s important that your higher education course is eligible for student finance to benefit from this. Also, if you’ve made additional repayments before starting your HE course, those payments are non-refundable.

You can apply for up to four Advance Learner Loans, and it’s possible to have more than one loan at the same time. This gives you flexibility if you’re taking multiple courses or progressing through different qualifications.

If you want to retake a course at the same level, like a Level 3 diploma in a different subject, you can apply for another loan for that course. However, for Access to Higher Education (HE) courses, you can only apply once, since these are designed as a single pathway into university.

For A levels, you can apply for a loan for each course you take, up to a maximum of four A levels. If you take each A level as two separate courses, this means you could potentially have up to eight loans, as long as the courses are in the same subject to count toward a full A level.

Not exactly. Student finance is the umbrella term for all funding options available to learners in England, including grants, bursaries, and loans. The Advance Learner Loan is one type of student loan specifically for adult learners taking eligible courses. So while a loan is part of student finance, student finance itself covers more than just borrowing money.

The Advance Learner Loan opens doors to education and career opportunities that might otherwise feel out of reach. With London Cactus College guiding you through the process, you can focus on learning, gaining new skills, and building the future you want.

Whether your goal is to become a nurse or start a career in health and social care, funding your learning doesn’t have to be stressful. Your journey can start today.

Share: